ADCS President’s Inaugural Speech 2024

ADCS President, Andy Smith, made his inaugural speech at a reception on 16 April in London.

Related Articles

There are no entries available.

Social housing allocations consultation

ADCS response to the recent DLUHC consultation on changes to social housing allocations:

Related Articles

There are no entries available.

Guidance for Schools and Colleges: Gender Questioning Children -...

ADCS response to DfE consultation: Guidance for Schools and Colleges: Gender Questioning Children

Related Articles

There are no entries available.

Comment: OCC report on children in need

ADCS President John Pearce said:

“This new report is welcome and makes a number of important points about the need to put early help on a statutory footing with dedicated, ring fenced funding, and calls for better national data. The government is developing a new family help offer in response to the independent review of children’s social care and the report raises important questions that could usefully play into this work. It is also clear the ambition set out can only be met if sustainable funding is allocated to local authorities for early help services.

“Each local authority has developed its local service offer over time to meet the needs of the local population, geography and context within the available financial envelope. As we enter the fourteenth year of austerity, this will look markedly different from place to place. This flexibility is particularly important here given the broad range of needs of the children we work with in this space, including homeless young people, families with no recourse to public funds and children with disabilities. It is important that social workers can use their professional judgement when assessing the level of support required and the frequency of visits. Therefore, any calls for consistency and blanket guidance must be carefully considered as services must be tailored to individual needs.

“ADCS will continue to engage with government on making sure children’s best interests are at the heart of these decisions.”

ENDS

Related Articles

There are no entries available.

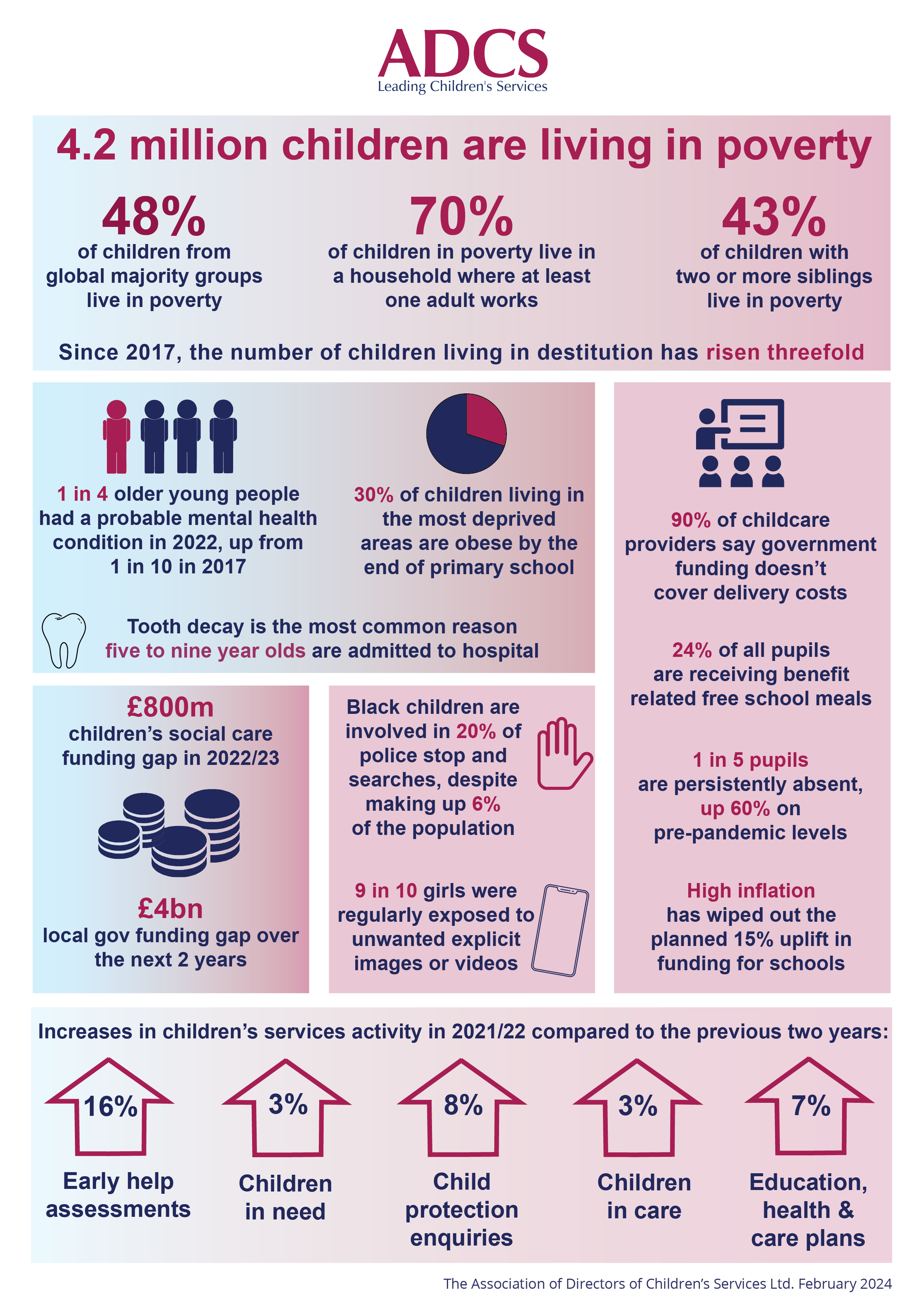

This is not a slow burning threat

In 2017 ADCS published A country that works for all children, a policy position paper which aimed to articulate the many challenges facing children and their families at the time and the wider contextual impact on them. That paper set out a range of asks for government to address challenges and the Association is updating this paper which will be published soon. Much has changed in seven years but not necessarily for the better, and the pandemic continues to impact on children and young people. Progress has not been made on urgent issues, such as child and family poverty and indeed things have continued to decline.

All children should be able to say, ‘my family and I don’t live in poverty and we’re not hungry’, they can’t. Over 4 million children in the UK live in poverty, the majority from working families and a rising number of families are experiencing destitution. Recent research by the Joseph Rowntree Foundation found over 1 million children were destitute in 2022, almost 3 times the number in 2017. Also, more and more families are relying on food parcels to get by.

Poverty is impacting our communities to such an extent that it underpins so many of the challenges that lead families to our door. The evidence is clear on the impact of poverty across all ages, it is linked to low birth weight in babies, poor physical and mental health and it is much harder to learn if you’re going to school hungry. Poverty affects life expectancy too, a recent review by Sir Michael Marmot found over 1 million people died earlier than they would have done between 2011 and 2019 if they lived in the wealthiest 10% of areas.

Successive governments have known about widening social and economic inequalities that are impacting children’s health, wellbeing and life chances for some time. There is also a differential impact on particular groups which enhances entrenched inequalities, for example analysis by the Runnymede Trust shows Black and minority ethnic people in the UK are over twice as likely to live in poverty as their white counterparts. This is not a slow burning threat; poverty is damaging childhoods, life chances and the future economy of this country now.

We urgently need the government to develop a national strategy to tackle the root causes of poverty, not just the symptoms. We can create the conditions in which all children in this country can thrive if the political will exists.

This column first appeared on the MJ website on 5 Feb 2024.

Related Articles

There are no entries available.

PR: Childhood Matters

Seven years ago, the Association of Directors of Children’s Services (ADCS) published A country that works for all children. The 2017 policy position paper aimed to articulate the challenges facing children and their families and put forward some solutions for change and asks of government which, sadly, remain unaddressed. Today, ADCS publishes Childhood Matters, an update to capture the changes that have happened in the intervening years and describe the current situation for children, their families and the public services they rely on.

The updated paper acts as an urgent call to arms to put children and families at the heart of all policy decisions and to invest in them and their futures. It reiterates the Association’s previous calls for a comprehensive long-term vision and plan for childhood and to address the funding gap in children’s services. It also identifies the most pressing priority for all the different government departments and agencies with a stake in child and family policy.

Since 2010, funding for local government has fallen by almost half in real terms and several councils are now effectively bankrupt, with more expected to follow suit. There is an estimated £4 billion blackhole in council finances over the next two years, and while local politicians have worked hard to protect children’s services budgets, over time more is being spent on child protection and care meaning there is less for early help and support. Emergency one off injections of funding, while helpful, do not negate the need for sufficient, long term funding for children’s services and local government.

John Pearce, ADCS President, said: “It is clear that children’s needs, rights and outcomes have not been prioritised in recent years. The cumulative impact of government policies and decisions on them, their families and the public services that support them is growing. The impact is evident from underinvestment in school buildings, the allocation of new funding via competitions to insufficient action on rising levels of child poverty, mental distress, and blatant profiteering by some private providers of children’s homes. During the pandemic pubs reopened before most pupils returned to school and even where there is significant planned investment in childcare, for example, the driver is getting adults back into work rather than children’s outcomes. What message does this send about our priorities as a country and how we value children in society?

He went on to say: “Clearly this country is not currently working for all children, we need the government to recognise this and act in a long term way. The need for action on child and family poverty, a new approach to funding and addressing the workforce crisis is arguably stronger than ever before. We need government to recognise its role in addressing these challenges and to work with councils and other public services to take action on deep rooted injustices and inequalities, which are widening rather than closing.

John Pearce concluded: “Childhood matters but because children do not vote they have not been a political priority. This is a pivotal moment in the nation’s relationship with children and families. A general election is on the horizon, a step change is needed in how government prioritises and invests in children, young people, their families and in public services. Not only is this the right thing to do, but it is the only way to secure this country’s future economic prosperity. Every childhood is a critical opportunity for us to make a difference, however, if the status quo continues I worry about the lives and life chances that are being left behind.”

ENDS

Related Articles

There are no entries available.

Childhood Matters

Childhood Matters

Childhood Matters acts as an update to the Association’s 2017 policy paper, A country that works for all children. It seeks to capture the issues and challenges facing children, young people and families, such as poverty and poor mental health, as well as the public services they rely on. This paper has been developed in consultation with leaders of local authority children’s services across the country. They expressed a shared concern about the lack of prominence and prioritisation of children within government policy and spending priorities as well as the difficulties in navigating the diffuse accountability arrangements across the multiple different departments and agencies each with responsibility for aspects of child and family policy.

As the next general election approaches, the paper identifies the most pressing priorities for each of the key nine departments, and agencies, with a role in child and family policy.

View Childhood Matters - Final Report (pdf)

View Childhood Matters - Executive Summary (pdf)

Related Articles

There are no entries available.

Policy must focus on better outcomes not just access to work

The greatest opportunities to make a real and tangible difference to a child’s life chances occur when they are very young, in the first five years of life. Evidence shows that babies born into poverty are more likely to have low birth weight and by the age of three are, on average, nine months behind in development terms than their wealthier peers. The attainment gap widens further in the school years. Access to early education and high quality childcare is linked to better academic results and improved cognitive and socio-emotional development in primary schools, particularly for children from disadvantaged backgrounds. It plays a crucial role in reducing the outcomes gap between the most and least disadvantaged children.

Improving children’s outcomes should be at the heart of any early years policy. While childcare has been a policy priority for successive governments, the aim has predominately been to get more parents into work. The 30 hours ‘free’ childcare offer for working parents of three and four year olds is poorly targeted, it effectively excludes the most in need households, yet individuals who earn up to £100,000 per annum can benefit from this offer. We are losing opportunities to make a difference to the most disadvantaged children and families. Reducing the income threshold would helpfully narrow the policy focus to the most in need households and any funding could be reinvested to help the early years sector recruit, and retain, the workforce they desperately need.

The funding attached to the existing 30 hour ‘free’ offer is insufficient to meet actual costs with providers having to pass costs on to families to make up the shortfall or face closure. This is affecting the viability of both individual providers and the sector as a whole. According to the Women’s Budget Group £1.8bn is required to make up the shortfall for existing funding entitlements, following years of chronic underfunding and pressures exacerbated by the cost of living crisis. There is significant underinvestment in the expansion of the offer to younger children the WBG said, estimating that an extra £5.2 billion would be needed in 2025-26 in addition to the extra £4.2 billion the government expects to be spending to cover the true cost of provision for all the funded hours.

By expanding the ‘free’ childcare entitlements more households will be able to benefit from the offer, however, these reforms have come at a time when the sector is facing significant challenges including high costs because of the cost of living crisis and severe workforce challenges, with a significant proportion of the workforce choosing to leave for higher paid roles in retail. A recent government consultation on how early years funding is distributed has concluded. However, no matter how carefully funding is distributed, if the funding envelope is not sufficient the market will not be able to successfully deliver on these new expectations, children and families will lose out.

The unique ability of the early years sector to close the attainment gap must be at the heart of designing and implementing any future reforms over getting parents into work. This should be backed by sufficient funding from central government to ensure the funding available reflects the costs of delivering the reforms.

This column first appeared in CYP Now website on 3 Jan 2024

Related Articles

There are no entries available.

Comment: profiteering in children’s social care

John Pearce, ADCS President, said:

“The children in our care deserve to live in homes that meet their needs and as close to the people and places they know as possible. However, finding the right home is increasingly difficult due to the significant shortfall in suitable homes in the right locations and this is particularly true for those children needing the highest levels of support. Local authorities can pay thousands of pounds a week for individual placements for children in their care while providers can choose which children to accept and at what cost due to high demand. We urgently need government to develop a comprehensive national placements strategy so that the right homes are available when and where they’re needed.

“Children’s services have long operated in a mixed economy with private, voluntary and community providers involved in the delivery of services locally. However, profiteering by some large private providers and growing private equity involvement into the provision of fostering and residential care placements is a concern as is the considerable levels of borrowing and debts that some private companies are holding. Should any of these providers fail, no single local authority could step in, and it would be children who suffer the greatest consequences. There should be a set of national rules to ensure the system is reset in favour of children’s best interests, not maximising profits. ADCS continues to call for new legislation which prevents profiteering in children’s services and for the introduction of pricing bands and caps.”

ENDS

Related Articles

There are no entries available.

Comment: EHE register

John Pearce, ADCS President, said:

“We have long raised with government the need for a register that gives us a full understanding of the number of children who are being educated at home, locally and nationally. We understand the government remains committed to introducing a register of children not in school, however, it is disappointing that this has not been implemented yet. A register in and of itself will not keep children safe but it will help to establish how many children are being educated other than in school and to identify children who are vulnerable to harm, we hope that a register is introduced at the soonest possibility.”

ENDS

Related Articles

There are no entries available.

Next government needs to reset Send system

At some point over the next 12 months, we’ll find ourselves heading into a general election where each party will set out their manifestos. For those of us in children’s services, we will be scrutinising what is being said about important issues such as child poverty, children’s mental health and local government funding. There are multiple priority areas that need urgent attention and focus nationally, however, I have been reflecting on what the immediate priorities for an incoming government should be.

The pressures in children’s services have been well documented and there is a plethora of evidence showing how demand continues to rise. However, we lack a funding settlement that recognises these pressures. Like many other sectors, the impacts of the pandemic are still being felt and will remain for years to come. We are seeing this in terms of greater complexity of need as well as new children and families coming into contact with children’s services. The pressures are being felt by all local authorities up and down the country and whilst our whole workforce is doing an inspirational job in keeping children and young people safe, we are operating in an increasingly difficult environment. Providing a proper, long term and sustainable funding settlement for children’s services must be a priority for any new government. Over a decade of austerity has resulted in local authority budgets being cut in half, forcing us to cut many of the services that allow us to support children and families early. This is a false economy which only stores up problems for the future.

Another area of priority focus must be on addressing the growing pressures in the SEND system. The system needs a reset to make it work better for all children and young people and to reduce the insurmountable costs that we are seeing threaten the financial sustainability of local authorities. The intended outcomes of the 2014 reforms have not been delivered, in part due to underfunding, with the number of education, health and care plans growing year on year and capital investment in new special schools not keeping pace with demand. Part of the solution would be to change the accountability system in our mainstream schools so that they are incentivised and appropriately funded to be more inclusive of all children, including those with additional needs. With the system as it is, there is a growing reliance on more costly independent specialist provision. Despite record levels of spending, more and more people are dissatisfied with how the system is working, something that has been acknowledged by the government.

Any incoming government must prioritise making this a country that works for all children. It must invest long-term in children, their families and the public services that support them and take a holistic approach to improving their lives. Local government can be transformative when at its best, but there is much out of our control such as growing levels of child poverty. We need a national government that is just as committed as we are to making change.

Andy Smith, ADCS Vice President

This column was first published in LGC in November 2023

Related Articles

There are no entries available.

Response to the coroner’s verdict following inquest into Ruth...

John Pearce, President of the Association of Directors of Children’s Services, said:

“Directors of children’s services, and their teams, understand all too well the heavy burden of inspection on the health and wellbeing of the individuals working in organisations being inspected, from senior leaders through to frontline staff. This has been brought into sharp focus by tragic events earlier this year, and by today’s verdict. Our deepest sympathies are with the family and friends of Ruth Perry.

“It is right that all of children’s services, including schools, are held to account for the important work that they do with children, and the outcomes they achieve. When there are issues, robust action should be taken to secure rapid improvement. Inspection should have a positive impact at a system level, providing assurance and supporting learning, and always be grounded in improving outcomes for children and young people and empowering staff.

“ADCS has long maintained that single worded judgements tell a partial and negative story, running the risk of weakening the very services the inspectorates seek to improve. Often, the consequences that follow a poor inspection outcome are disproportionate and have an unintended ripple effect across the workforce. A poor inspection outcome can lead to a high staff turnover making it difficult to address the very issues raised and ultimately improve services for children and families.

“There is a clear need for a wider debate about the role and impact of inspection with government, who are responsible for commissioning the framework for inspecting schools, local authorities and other public services, and critically, the interventions and consequences that follow. Meaningful change can only be delivered by government as the ultimate regulator, rather than individual inspectorates and this requires an open dialogue.”

ENDS

The Association of Directors of Children’s Services (ADCS) Ltd is the professional leadership association for Directors of Children’s Services and their senior management teams in England.

Related Articles

There are no entries available.

ADCS President’s address at the National Children and Adult...

ADCS President’s address at the National Children and Adult Services Conference 2023

Addressing delegates at the National Children and Adult Services Conference in Bournemouth, John Pearce, President of the Association of Directors of Children’s Services (ADCS), today said:

On child poverty:

“The Joseph Rowntree Foundation recently published its fourth study on destitution across the UK… the study found that around one million children in the UK experienced destitution in 2022, this is triple the number of children in 2017… How did we arrive at a place where one million children have not had their most basic needs met? It has become clear that many of the challenges we face have been created or exacerbated by national policy decisions…”

On education:

“You may remember that last year, the Schools White Paper landed… the following day, the SEND and Alternative Provision Green Paper was also published and the link between the two was clear for all to see… For the first time in a long time, we had a welcome and clear articulation of what an inclusive education system would look like, it all felt too good to be true and unfortunately it was! The Schools White Paper was put back on the shelf and the Schools Bill withdrawn… This is why ADCS has today published a vision for the future of the education system.

“Too often the education debate is too narrowly focused on schools, at the expense of early years settings and further education colleges… the early years provide the best opportunity to close the attainment gap… the government has announced major investment and reform for childcare, but it’s based on getting parents back into work, rather than supporting professionals to give children the best possible start in life… The same is true of further education. For many young people, vocational routes offer the best opportunity for study and development… It is clear that the education system needs change. It needs a long-term vision and crucially, it needs to work for all children and young people.”

On funding:

“Councils up and down the country are… facing the real prospect of issuing Section 114 notices and the biggest financial risks now lie in the service areas we are responsible for, those we provide to children and adults… The significant cost pressures on children’s services are in the main driven by either national policy, or the retrenchment of our partners into what they regard as their ‘core’ business… In children’s services this will mean moving more funds away from essential early help… we are not and should not be a blue light service… Government has been promising a new funding formula for years, it’s time to bite the bullet before it’s too late.”

On the agency workforce:

“The government recently published its response to the child and family social worker workforce consultation and ADCS welcomed this as a positive step in the right direction… however, we would have liked the proposals to go further and continue to see no positive case for members of project teams to have a statutory case holding role… but for the time being, there is a plan which now needs to be implemented at pace.”

On children’s homes placement pressures:

“It cannot be right that the largest 20 independent providers of children’s social care homes made more than £300 million of profit last year, every penny of which came directly from the public purse… we need government to act on this now… Earlier this year ADCS developed an alternative vision for regional care cooperatives… Ultimately, we need a national set of rules to drive a level of transparency through the system that enables local authorities to develop and operate commissioning models which are rooted in the needs of children, rather than shareholders.”

On partnerships and Working Together, the statutory guidance for safeguarding partners:

“…It becomes deeply problematic when partners do not interpret their fundamental safeguarding responsibilities as core to their functions, a good example being the Right Care Right Person programme being implemented by the Police. The updated Working Together guidance must be clear about the expectations of safeguarding partners and their responsibilities to children and young people. Very rarely is a single agency response enough but we don’t have the models available to us to respond in a way that I am sure both children’s social care and health colleagues would want to. A shared endeavour with the creation of an integrated response through a children’s better care fund could provide a delivery vehicle for some of this work.”

On the national transfer scheme (NTS) for unaccompanied asylum-seeking children:

“…The NTS was established as a voluntary scheme in the summer of 2016, which seems like a lifetime ago… It was not designed to deal with the huge increase in numbers of children arriving… While the recent high court judgment has significant implications for the functioning of the NTS… it helpfully clarified the primacy of the Children Act 1989 and the duties local authorities owe to all children in this country… It’s clear children’s needs must always be front and centre in everything we do, not just morally but also legally.”

ENDS

The Association of Directors of Children’s Services (ADCS) Ltd is the professional leadership association for Directors of Children’s Services and their senior management teams in England.

Notes:

• The full speech can be found on www.adcs.org.uk

• The ADCS policy paper on the future of the education system mentioned in the speech can be found on www.adcs.org.uk

Related Articles

There are no entries available.

ADCS President’s address NCASC 2023

John Pearce, President of the Association of Directors of Children’s Services made his keynote speech at the National Children and Adult Services Conference in Bournemouth,

Related Articles

There are no entries available.

ADCS response: LGA research on placement costs

Responding to new LGA research on the cost of children’s social care placements John Pearce, ADCS President, said:

“This report highlights several important issues that ADCS has been consistently raising with government for years. The unmanageable costs of children’s social care placements, and the significant shortfall in suitable homes for children in our care has led to a crisis in the sector that needs immediate national action. Local authorities are the sole purchasers of placements, yet are often held to ransom by private providers due to lack of sufficiency meaning costs can be thousands of pounds a week for individual placements for children in their care. Providers can pick and choose which referrals to accept and set the price due to overwhelming demand particularly for placements for children with the complex needs. These and other issues, such as profiteering by some private providers which takes money out of the system when it should be spent on children, cannot be solved by councils alone and central government action is needed to help us meet the needs of children in care. A comprehensive national placement strategy is needed to ensure the right placements are available in the right locations and at the right time. This will need national rules to intervene and regulate all of those who wish to provide homes for our children in care. The government must now act to ensure children can access support and homes that meet their needs as well as ensuring value for money from public funds.”

ENDS

Related Articles

There are no entries available.

Comment: HMI of Prisons report Children in Custody 2022/23

Helen Lincoln, Chair of the ADCS Families, Communities and Young People Policy Committee, said:

“It must not be forgotten that children in conflict with the law are first and foremost children. We should be doing all we can to divert children away from the youth justice system and to ensure it is safe for, and meets the needs of, the children already in contact with it. These children are often amongst the most vulnerable groups in our society and have complex and overlapping needs, many will have mental health issues or have been in care. The aim of any sentence must be to give children an opportunity to resettle into society and break the cycle of reoffending whilst keeping them safe and promoting their mental health and emotional well-being. It is difficult to see how conditions described in this report, such as high levels of self harm, violence and spending long periods of time alone in cells, help achieve these aims. While we understand the need to protect the safety of staff, the introduction of PAVA is seriously concerning and at odds with the government’s stated ‘Child First’ aims. We must do better for children in and on the edge of the youth justice system. “

ENDS

Related Articles

There are no entries available.

Youth Services are a ‘must have’

As a society we don’t value young people enough. When young people ‘hang around’ in the streets most people will think they are up to no good, yet hundreds of youth centres have closed giving them nowhere safe to go. We need to invest in our young people, we need to recognise the significant contribution they make to society in the present as well as in the future.

Youth work can be transformative, it can help young people build trusting relationships, experience positive activities, improve their resilience, and give them safe places to be outside of school. It can happen in a variety of settings, such as youth clubs or faith groups, open access youth work can take place in a mobile unit like a bus or out in the community in a park. During the pandemic, we saw some innovative work to engage and support young people, such as online quizzes, sharing activity packs and walk and talk approaches to support those who were at risk or struggling. Youth workers make a difference in young people’s lives, yet they are an undervalued part of the wider children’s workforce.

Austerity policies have significantly impacted young people and youth work. An estimated 600 youth centres closed between 2012 and 2016, limiting the opportunities available to our young people. Local authorities and youth organisations have done all they can to continue delivering services, including by reshaping services, because we recognise their value and long-lasting impact on young people, but a lack of government funding to support us with this means services have had to be scaled back or closed altogether. It cannot be a surprise to anyone that we have subsequently seen significantly increased demand in specialist and high cost services for young people.

Across large rural areas, provision is spread thinly creating a post code lottery of access. Some local authorities have responded to government budget cuts by refocussing their youth services into a single hub, often in the town centre, while well meaning, these ‘youth zones’ can be exclusionary, most young people will need to travel to access it and there might not be the public transport links to do so, or they may not be able to afford it.

At a time when life is getting harder for children and young people because of rising poverty, increasing poor mental health and long waiting lists for help, now is the time to invest in our young people.

Though there has been some welcome government investment in young people, such as the National Youth Guarantee and the National Citizen Service (NCS), this falls short of what is needed, and the latter has had mixed evaluations in terms of impact and value for money. Youth services need long term sustainable national funding to ensure all young people can benefit.

We should be doing all we can to reach and engage young people and a big part of this is ensuring we have a strong youth work offer that is accessible and available to all young people. Youth services are not just ‘nice to have’ they are ‘must haves’ if we want young people to thrive.

John Pearce, ADCS President

This article first appeared in CYP Now on 24 October - Access to Youth Work: Key policy developments | CYP Now

Related Articles

There are no entries available.

ADCS response: King’s Speech 2023

Responding to the King’s speech announced today, John Pearce, ADCS President, said:

“Unfortunately the speech missed an opportunity to focus on a significant long term challenge affecting children, their health, wellbeing and their ability to learn in school today – poverty. Poverty damages childhoods and children’s life chances, despite a mountain of evidence showing the impact of poverty on children’s lives we have not yet seen sufficient action from government on this. We urgently need national strategies that reduce and ultimately end child poverty. Children may not vote but they are our now as well as our future. Children need to be at the heart of all government policies with long term investment in them and the public services that support them.

“We do welcome the government’s ambition to create a ‘smoke free generation’ which, if achieved, will be positive for children. Local authorities are also committed to working with our partners to keep children safe from abuse in all its forms. England has one of the safest child protection systems in the world and this is made possible by a dedicated and committed social work, and wider children’s workforce. ADCS will be responding to the new government consultation on mandatory reporting in due course.”

ENDS

Related Articles

There are no entries available.

Childcare Reforms - The MJ

Early years policy has been a focus for all recent governments, however, improving the life chances of children must be at the heart of any early years policy, over and above increasing the number of parents in work. The greatest opportunities to make a tangible difference to a child’s prospects occur when they are very young, in the first 1001 days of life. Access to early education and high-quality childcare during this time can have a real impact on children’s outcomes, particularly for the most disadvantaged children. It plays a crucial role in reducing the outcomes gap between the most and least disadvantaged children.

Local authorities have worked closely with providers to deliver the current 30 hours ‘free’ childcare for working families of three and four year olds, yet funding is insufficient to meet actual costs with settings having to pass additional charges and costs on to parents to make up the shortfall. Moreover, many of the most in need households are not eligible for support, yet children of parents who earn a combined income of up to £199,000 per year can benefit from this policy. ADCS believes help with childcare should be targeted at the most socially and economically disadvantaged families. Reducing the income threshold would helpfully narrow the policy to focus on these families, and any funding saved could be reinvested to help the early years sector recruit, and retain, the high-quality workforce they urgently need.

In the Spring Budget, the Chancellor announced an extension of the 30 hours offer and increased funding rates for children from nine months of age, which is good news for families who are struggling with the cost of childcare. However, despite the Department for Education’s expectation to invest £4.1bn by 2027/28 to deliver the offer, early years providers are reporting that this funding will still not cover their costs. The Education Select Committee’s recent report on childcare reforms was clear that simply extending the number of funded hours won’t have the desired impact unless funding accurately reflects the costs to providers.

A lack of sufficient funding is not the only thing the sector is struggling with. Early years providers are also still feeling the effects of the pandemic. Financial impacts have led to closures and staffing issues. Early years workers have had to adapt to the needs of children whose development has been impacted by pandemic restrictions, including effects on their confidence, gross motor skills, communication and language development. Providers are also dealing with rapidly growing costs due to the cost of living crisis and severe workforce challenges, with a significant proportion of the workforce choosing to leave for better paid roles in retail.

Nothing is more important than improving children’s life chances and the best chance we have to do this is in the early years of children’s lives. The government would be wise not to overlook the value of the early years sector, who work incredibly hard to support our youngest children.

Andy Smith, ADCS Vice President 2023/24

This article first appeared in the MJ on 26 August - Maximising early years’ potential (themj.co.uk)

Related Articles

There are no entries available.

Comment: National Transfer Scheme

Andy Smith, ADCS Vice President, said:

“The High Court judgment on 27 July further highlights how the way in which we care for and support unaccompanied children who are fleeing desperate situations does not work. The National Transfer Scheme (NTS) no longer effectively functions; the scheme was not designed to support the dispersal of such high numbers of unaccompanied children and young people which is why we need a comprehensive system wide review of how it operates.

“There are inherent system pressures impacting on the ability of local authorities to support the efficient functioning of the NTS, such as a lack of adequate funding, a national shortage of placements and local authorities are supporting an increasing number of former UASC care leavers. Local authorities are proactively exploring all options available to them to find suitable places for children in their care to live and to reduce the insurmountable pressures placed on Kent as a result of the judgment. We do not believe the proposals in this letter will sufficiently expand placement capacity in the way that we need, and not in the time frame we need. ADCS has serious concerns about the reforms to semi-independent accommodation, recent research suggests the reforms could increase costs and significantly reduce capacity when we need it most. Furthermore, you can’t reopen a children’s home overnight not least because there is a shortage of registered managers and residential care workers to staff the homes. We need a coordinated plan over the short, medium and long term to meet the needs of unaccompanied children who need our support. ADCS is actively engaged in discussions with government to try to find a sustainable solution to the way in which the system responds to the needs of unaccompanied children and young people arriving in the UK.”

END

Related Articles

There are no entries available.

ADCS Conference 2023

The Association recently held its annual conference in Manchester. This event provides the time and space for our members to debate and discuss our shared challenges but also solutions being developed locally in response to the increasing challenges children, families and local authorities currently face. There aren’t many opportunities in the annual children’s services calendar for us to come together in this way, but it is crucial as we strive to improve local services and outcomes of children and families.

We heard from the President of the Family Division, Sir Andrew McFarlane, in a thoughtful session about the family justice system. There was a specific focus on a wicked issue impacting the courts, local authorities and, most importantly, children and their families, a rise in applications to the National Deprivation of Liberty (DoLs) Court for children who are in crisis. This was an issue I highlighted in my speech to conference. There has been a near 500% increase in the number of applications to deprive children of their liberty in recent years, many of whom have multiple overlapping needs and experienced significant trauma, earlier childhood abuses and more. This is partly because we are working with a mental health system and a children’s placements system that are broken and we need major national strategies to address this. I think everyone can agree there is a need for the system to respond differently to better meet children’s needs, maintaining the status quo is untenable.

The government’s plan to reform children’s social care, Stable Homes Built on Love, was a frequent topic of discussion at conference. During this period of pilots, pathfinders and consultations it is important to remember the independent review recommended a crucial injection of £2.6 billion for implementation of the reforms. The totality of funding for children’s services is simply not enough and the scale of reform described in the government’s plan simply can’t be delivered if councils are financially compromised. There is a risk that the financial vulnerability of Councils will overtake the potential benefits of the reform programme.

Child and family poverty was a strong theme at conference this year as was children’s mental health, two of our many burning platforms. Directors of children’s services have a statutory duty to ensure the very best outcomes for children and families but there are factors that hinder our ability to improve outcomes. I have said a lot since becoming ADCS President about the crisis in children’s mental health and about how life is getting harder for children and families. Record levels of inflation and poverty have exacerbated existing inequalities and the children’s mental health system simply doesn’t work for children, children want change. These issues remain priorities for ADCS, they must be for government too. We need major policy change in these areas.

With a general election approaching, there is an opportunity to prioritise children. Children may not vote, but supporting them to have safe, happy child hoods and to thrive as adults will benefit the whole of society.

John Pearce, ADCS President, 2023/24

ADCS Annual conference, first appeared in LGC.

Related Articles

There are no entries available.

Mental health in schools

Poor mental health and wellbeing can have a lasting impact on children and young people’s life chances, but they face multiple pressures in their lives that adversely affect their mental health. The numbers are stark: one in six children have a probable mental health disorder, up from one in nine prior to the pandemic. We must be ambitious if we are to meet the growing, and urgent, need for mental health support both inside and outside of the classroom. Accessing the right support early can make a huge difference, yet too many children are waiting months for an assessment and over a year for treatment. We need far better access to mental health services for children and young people with waiting times for accessing CAMHS being far too long, however, schools also play a key role.

We know that schools are often the best environment for early identification where teachers, school counsellors and learning support staff see children every day and can spot the signs of distress quickly. Most mental health illnesses begin during childhood but unless problems are diagnosed early, we cannot provide the help and support that many children urgently need, in school, the community or at home. A Target of 35% of schools having a mental health support team does not go far enough, nor does it recognise the crisis in children’s mental health that we face. It is positive to hear government outline its commitment to giving mental health a renewed focus in the curriculum, but we need a sustainable long-term funding strategy for children and young people’s mental health that leaves no child at the mercy of a post-code lottery, especially as schools are facing their own funding pressures. Teachers must also be given the time and resource to deliver these important messages effectively.

Children and young people face multiple pressures, both online and in the classroom and these have only been exacerbated by the pandemic. They sacrificed months of their learning during partial school closures and we are now seeing some of the impact of this, however, many teachers are reporting being unable to access CAMHS or other relevant support. We need to think differently about how we integrate services across place so that children’s outcomes are at the heart of every decision made by all partners. This goes beyond structures, but focuses on how we can meet all children’s needs, with local schools and community services better connected. The role of local authorities as leaders of place would be key here.

Local authorities, schools and education settings are doing all they can to respond to the situation, including by stepping in when children cannot access the support they need, but this is not sustainable. The current system is not working, yet children and young people tell us it is their biggest concern. We owe it to them to get it right and show them we are listening.

John Pearce, ADCS President 2023/24

This article: Connect schools and communities to better support children, first appeared in CYP Now.

Related Articles

There are no entries available.

PR - President’s speech to the ADCS Annual Conference 2023

The President of the Association of Directors of Children’s Services, John Pearce, used his speech to the ADCS Annual Conference, today, to reflect on the government’s response to the independent review of children’s social care, Stable Homes Built on Love, “most of which ADCS has welcomed”. For example, the government’s commitment to publish a kinship care strategy feels likes an “opportunity to make a real difference to a group of carers and children” who haven’t previously had enough focus and attention, he said.” Any reforms would need to be met with adequate funding.

John Pearce highlighted several issues ADCS has urged government to take “swift and decisive action on”, such as the “unaffordable costs and…blatant profiteering, that’s associated with agency social work and in particular, the growth of project teams”. The sector as a whole has “rallied behind the proposals” in the consultation on the agency social work workforce, he said, “as have children and young people”. ADCS members are “committed to working with government on implementation of the full suite of proposals” at pace. “It is not an easy set of reforms to deliver…but we must hold our collective nerve”, he urged.

John Pearce went on to say, finding placements for children in our care is such a “critical plank” of the children’s social care reform programme “that we can’t afford to get it wrong”. The government has accepted the Competition and Markets Authority’s recommendations to address the current “dysfunctional” placements market, yet there is no strategy that delivers on them. The lack of placement sufficiency and the associated challenges this brings are “unprecedented”. “I fear that we will reach crisis point before we are able to reap any of the wider benefits envisaged by the reform programme”, he warned.

Regional Care Cooperatives (RCC)

“....We have offered up some constructive challenge to government and set out an alternative vision for the RCC concept. This includes a summary of the prerequisites for success which must be delivered nationally, which we believe will help us to deliver for children and young people. A set of national conditions for success need to be in place before we can even think about trying to implement reforms, these include a workforce plan, a multi-year funding settlement, a more ambitious capital programme and possibly most critically a move to bring regulations up to date – it’s been two decades since the last substantial review and the world has changed a lot in that time, not least the needs of children and young people and how we respond to them.”

Inclusive education

“For children and young people, the impacts of the pandemic were in many ways greater than for us adults. They were broadly at lower health risk but they willingly gave up their educational experience and social development to protect the adults in their lives and their local communities. Outside of health and social care settings, the disruption to places of education extended far beyond initial lockdown periods. Who amongst us…can forget the herculean efforts required to manage bubbles, navigate staggered drop off and pick ups, new handwashing regimes, segregated playtimes, and cancelled events and activities?

“In many ways this broke the social contract between parents, children and their schools. The impact is clear to see in the ongoing levels of persistent absence, in the reports from schools about disruptive behaviours, in difficult transitions from primary to secondary school, in levels of worry and stress about sitting exams for the first time. In many cases we don’t yet know what’s learning loss or developmental delay and what’s new need. An inclusive system of education needs to recognise these challenges; a long term national plan is needed to support children to recover from this experience.”

SEND

“Since the Children and Families Act 2014, we have seen a rapidly increasing drift away from inclusion in mainstream schools, and at the same time an over reliance on independent specialist provision. Education, health and care plans were only ever intended to better meet the needs of a small cohort of children with more complex health and learning needs who required support across the three domains, they were not designed to be akin to supercharged special educational needs statements but yet they are now seen by many as the only gateway to access any form of additional support…The level of demand in the system is not mirrored in the allocation of resources.

“The SEND Review: right support, right place, right time, produced a clear and shared narrative about the challenges in the system, however I’m not sure we have landed on a good enough narrative as to how we will address them. There isn’t a policy solution to the cost and demand that is set within the current system, and baked in for many years to come, without significant national intervention and legislative reform.”

On migrant children and the asylum system

“…We urgently need a new conversation with the Home Office and the Department for Education about migrant children, one that is conducted in the true spirit of co-production and focused on the system as a whole. Every year, as the weather improves and more small boats arrive, we have the same conversations and crisis response. More recently, the pressure hasn’t been as seasonal, it’s been constant as we try to manage the demand on children’s services created by Home Office asylum hotels, and soon to be created large adult asylum sites. Some aspects of the current system need urgent change, it’s simply not acceptable that age disputed young people from Home Office commissioned hotels are treated as spontaneous arrivals to host local authorities, this is clearly not the case. They have been placed there by the Home Office so there is nothing spontaneous about it and the disproportionate impact on host local authorities is becoming an increasing issue we need to revisit now.”

On mental health

“…I once again want to call for a national review of the children’s mental health and wellbeing system…we need to reset the system. It is clear it is not working for children and young people and mental health is always the top issue children raise with us. We have a duty to respond when they tell us it’s not good enough.”

The full speech can be found here.

Related Articles

There are no entries available.

ADCS President Conference Speech 2023

John Pearce’s speech to the 2023 Annual conference - 6 July 2023

Related Articles

There are no entries available.

Comment: LGA research on 30 hours free childcare extension

Chris Munday, Chair of the ADCS Resources and Strategy Policy Committee, said:

“The greatest opportunities to make difference to a child’s life occur when they are very young, between 0-5. Access to high quality education during this time is important because it plays a crucial role in reducing the outcomes gap between the most and least disadvantaged children.

“Local authorities have worked closely with providers to deliver the current 30-hours free childcare offer for working families, yet under the existing system funding is insufficient and many of the most disadvantaged households are not eligible for support. The shortfall in costs means some providers have had to close or pass costs onto families.

“Early years policy has been a focus of all recent governments, with the twin objectives of giving children the best start in life and increasing the number of working families, and this is welcome. However, we have two concerns about the proposed extension of the free childcare offer, the first is about the risk of losing the chance to make a difference to the most disadvantaged children and families and also the need for specific resource to enable the continuation of high quality childcare that meets the needs of children and families. Reducing the income threshold would helpfully narrow the policy to focus on the most disadvantaged children and families and any funding saved could be reinvested to help the early years sector recruit, and retain, the high-quality workforce they desperately need.”

ENDS

Related Articles

There are no entries available.

ADCS President’s Inaugural Speech 2023

John Pearce’s inaugural speech as ADCS President, delivered on 18 April at King’s Place, London

Related Articles

There are no entries available.

ADCS response: funding for school buildings and places

Steve Crocker, ADCS President, said:

“The investment in schools and colleges announced today is welcome. Significant underinvestment in the school estate in recent years has left school buildings dilapidated, and in some cases very unsafe according to the Department for Education’s own annual report. The safety of pupils and the staff working with them should be a priority for the government. £1.8bn is a reasonable starting point but significantly more capital funding will be required in the medium to long term to ensure all children and young people have safe learning environments.

“Additional investment to support councils to provide additional school places is welcome. The school system of the day is increasingly fragmented, local authorities are responsible for sufficiency in place planning, but we increasingly lack influence in the planning and establishment of new schools. To support local authorities to ensure every child has a school place in the areas they are needed, where new free schools are opened there must be better coordination with local need and priorities. “

ENDS

Related Articles

There are no entries available.

Comment: Illegal Migration Bill

Steve Crocker, ADCS President, said:

“In an ideal world children would not need to risk their lives taking dangerous journeys across continents in search of safety, but they do. They make desperate decisions to leave everything they know and love behind and travel alone because their lives are genuinely in danger, and they deserve our compassion, kindness and support. All new legislation should be child-focused and protect children’s rights. We await further information from government on the Illegal Migration Bill and the impact it may have on vulnerable children, young people and their families fleeing extremely desperate situations.”

ENDS

Related Articles

There are no entries available.

ADCS response: Children’s social care implementation...

Responding to the children’s social care implementation strategy Steve Crocker, ADCS President, said:

“We welcome the publication of the children’s social care implementation strategy. Local authority children’s services, up and down the country, support thousands of children and families each day, keeping them safe from harm. We hope these reforms will allow us to improve the system by building upon the areas of strength that the strategy identifies. The care review, like many other reports, highlights chronic challenges that stand in the way of improving outcomes for children and families. The system needs urgent change and directors of children’s services want to work with government, and others, to achieve this.

“While there is much we welcome it is important that any forthcoming reforms to special educational needs and education dovetail with this strategy. Indeed, the strategy’s emphasis on multi-agency working will be essential to the success of these reforms. When the government consults on updating the Working Together guidance all safeguarding partners will need clarity on their responsibilities and how they will be held to account to ensure that they deliver for children and families.

“The emphasis in the strategy on tackling racial and mental health disparities is welcome, as is the focus on providing earlier support for children and families through revised Family Help arrangements, greater support for care leavers and addressing recruitment and retention issues amongst foster carers and social workers. We are pleased the government has listened to our advice and is taking a ‘test and learn’ approach to implementation. It is important for the sector to have the space to explore what works and, crucially, take the time to pause and re-evaluate where things don’t work as intended. Collaborative commissioning may offer part of the solution to the complex set of issues we currently face in relation to children’s placements, but it is unlikely to achieve the desired results without a shift away from profiteering in the children’s placements market. There is need for greater government action here.

“The current financial context for local authorities is tough and so any additional investment to fund local pathfinders before wider rollout is welcome, however, the level of funding beyond the next two years remains unclear. Getting change right for children requires proper, equitable resourcing. ADCS is keen to work closely with government and others during this implementation phase and will be responding to the consultations published today following discussions with our members. We encourage others in the sector to do the same to help shape these important reforms. We need the buy in of our partners in health, schools and others to achieve real change.”

ENDS

Related Articles

There are no entries available.

ADCS response: Prime Minister’s New Year speech

Responding to the Prime Minister’s New Year speech Steve Crocker, ADCS President, said:

“ADCS shares the Prime Minister’s ambition to ‘build a better future for children’. Strengthening the economy and ensuring children receive a high-quality education are important parts of this. However, children cannot thrive if they are living in poverty – but the Prime Minister was silent on this issue today. The government must set out steps to reduce and ultimately end child poverty without delay. Without this we remain far from a country that works for all children and families.

“Change and the importance of family were key themes in the Prime Minister’s speech today and we must make the most of the opportunities to reform the education, children’s social care and special educational needs systems, to benefit children and families. ADCS members stand ready to work with the government and sector partners to achieve this, but children’s services will need proper, long-term, sustainable, and equitable funding.”

ENDS

Related Articles

There are no entries available.

ADCS comment: Safeguarding Pressures Phase 8 full report

The Association of Directors of Children’s Services (ADCS) today, publishes the full report of its latest iteration of Safeguarding Pressures research. ADCS has collected qualitative and quantitative data from local authorities to evidence and better understand changes in demand for, and the provision of, children’s social care services since 2010. The eighth phase of the research brings the evidence base up to date and compares data over a fourteen-year period. The report draws on evidence from 125 local authorities, covering 84% of England’s child population. This, together with existing data, provides a unique insight into safeguarding related pressures facing children’s services in England in 2020/22.

Phase 8 covers the first two years of the pandemic period, a time of significant uncertainty and change in the context in which children and families are living and public services were operating. Most local authorities experienced a reduction in demand for their services during the first few months of the pandemic linked to national lockdowns. However, many local authorities are now seeing an overall increase in safeguarding activity in response to the multifaceted challenges children and families face. A ‘post pandemic’ state has not been reached but we need to be in a position to sufficiently respond when latent need emerges.

As at 31 March 2022:

• There were 2.77 million initial contacts received by children’s social care in 2021/22, an increase of 10% in the last two years

• An estimated 282,320 early help assessments were completed in 2021/22, a 16% increase in the past two years

• There were 650,270 referrals made to children’s social care in 2021/22, an increase of 21% since 2007/08, when this research began

• The number of children subjects of child protection plans in 2021/22 has increased by 74% since 2007/08

• 217,800 section 47 enquiries were undertaken in 2021/22, up 184% since 2007/08

• The number of children in care has increased, up 35% since 2007/08, as has the number of care experienced young people being supported by local authorities

• Parental domestic abuse, substance misuse and poor parental mental health remain some of the most common reasons why children come to the attention of early help and/or children’s social care services

• ‘Abuse or neglect’ remains the predominant reason for referrals to children’s social care services and children coming into care.

Local authorities have a legal duty to keep children safe from harm and to promote their welfare. Twelve years of austerity and a 50% real terms reduction in local authority budgets, plus reductions in other public services, has impeded the ability to work with children and families as early as possible to prevent the escalation of need. Disparate pots of time-limited grant funding from government and local authority investment over the past two years has helped to alleviate some demand pressures. However, this is no substitute for a long term equitable and sufficient funding settlement for all local authorities, which all children and families would benefit from, no matter where they live.

Steve Crocker, ADCS President, said: “This report offers further insights into the impact of the pandemic on children, local communities, and public services. We have seen significant learning loss, particularly for more disadvantaged pupils, at all key stages and ages and attendance at education settings has yet to recover to pre-pandemic levels. Despite a significant fall in safeguarding activity in 2020 linked to lockdowns, higher levels of need and risk are now being seen in children’s social care in 2022 and families continue to present later, with complex, multifaceted needs which are more acute. A sharp increase in claims for free school meals and a clear deterioration in children’s mental health and emotional wellbeing adds to this worrying picture with unplanned arrivals of unaccompanied asylum seeking children at the highest level in years adding further complexity.

He went on to say: “It will still be some time until we see the full impact of the pandemic and we are now facing a cost of living crisis. Day in, day out, we are working hard to support children and families and should be readying ourselves for whatever comes next, but our staff are stretched to breaking point. Families are less resilient than they were, and so are public services. This research highlights the many challenges we face in identifying or meeting children’s needs as early or as well as we would like to. Sadly, were it not for the pandemic experience, some of these needs could have been met earlier in the system and not escalated to crisis point. On top of this after 12 years of austerity and hand to mouth funding for local authorities, we do not have enough social workers or placements for children in care and the cost of both are spiralling. Funding does not match the levels of need we are seeing. Too often funding is allocated on a competitive and short term basis or taken out of the system completely, lining the pockets of rapacious hedge funds. On top of all this, we are increasingly worried about the cost of living crisis and how many more children will fall into poverty, reducing their quality of life and their life chances. The system is crying out for change.

Steve Crocker concluded: “Throughout the report, leaders of children’s services shared their worries about the difficulties they face, their fears for the future but also their appetite for system change alongside a new funding settlement for children and families. There is an opportunity to change within our grasp via a series of reforms to social care, education and special educational needs policies and we stand ready to play our part. We simply can’t go on as we are. Our children deserve better, and so do our workforce. Government must draw together at a national level the separate policy initiatives and pots of funding for unconnected policy intentions, initiate a shift away from private sector profiteering and into one substantial coherent whole that invests funding in the right places within the system. That way, we can make this a country that works for all children.”

ENDS

The Association of Directors of Children’s Services (ADCS) Ltd is the professional leadership association for Directors of Children’s Services and their senior management teams in England.

Related Articles

There are no entries available.

ADCS response: Ofsted’s annual report 2021/22

Steve Crocker, ADCS President, said:

“This report adds to the growing evidence base capturing the disruption caused by Covid-19 to public services and its impact on children’s lives. The pandemic has led to a significant deterioration in children’s mental health, lost learning across all ages, very young children with speech and language delays and missing other important developmental milestones and attendance is not yet at pre-pandemic levels. Furthermore, children are now coming to the attention of children’s social care with more complex and acute issues, which we will need to meet. Staff across education and social care are working extremely hard and at full capacity to support children to recover from the immediate impact of the pandemic, despite being overstretched and exhausted, but there is more work to do. On top of this we now face a cost of living and energy crisis that will place further pressure on households, staff and services, making this work more difficult. Latent need from the pandemic has yet to emerge, and for services and the workforce to be in a position to respond when it does, we need government’s support. This must include addressing longstanding workforce challenges right across early years, education and social care sectors which, as the report notes, are compounding many of the issues highlighted in this report and impeding efforts to support recovery.

“We share HMCI’s concern that children are bearing the brunt of workforce shortages right across education and social care. Without enough teachers, social workers, staff in early years settings and children’s homes and without enough foster carers and placements of all types for children in our care, in the right places how can we ensure children’s needs are met? We need to make the most of the opportunities in front of us to reform the education, social care and special educational needs systems, to tackle profiteering by some on the backs of vulnerable children and manage the rising use and cost of agency social workers. ADCS want to work with the government on this. We can and we must do better for children.”

ENDS

Related Articles

There are no entries available.

ADCS response to PLWG SO consultation

Read the ADCS response to the consultation on the PLWG’s report on the use of Supervision Orders.

Related Articles

There are no entries available.

ADCS response: Report on the Children and Families Act 2014

Responding to the House of Lords report ‘Children and Families Act 2014: A failure of implementation’, Steve Crocker, ADCS President, said:

“This report underlines many of the challenges we’ve been raising for some time and does it in a clear way. The 2014 Act aimed to improve services for and the lives of vulnerable children. Some of the reforms included here are having a real and tangible impact, such as the role of the virtual school head in supporting the education of children in care. Other reforms included in the Act have progressed less well, or have not had the desired impact for a whole host of reasons, including those relating to special educational, needs and disabilities. Often the sufficiency of funding is an issue but there are also difficulties in having the right data or levers to understand what needs to happen and influence others. Whilst mental health services were not covered in the reforms, the committee draws attention to the difficulties children and young people face in accessing timely support and asserts that the government has not grasped the importance or severity of this problem, my fellow directors and I can only agree. ADCS has repeatedly raised the issue of children’s mental health and emotional wellbeing and the urgent need for a review of children’s mental health services - the current system is not working for children and it threatens to overwhelm the social care system.”

ENDS

Related Articles

There are no entries available.

Social, emotional, and mental health

The 2014 SEND reforms were ambitious, rightly raising expectations and extended entitlements to support for children with special needs and disabilities from birth up to 25 years, but for myriad reasons, they have not delivered the intended outcomes. Despite record levels of spending there is growing frustration and dissatisfaction on the ground from all sides.

Over the summer, the Department for Education has been consulting on the proposals outlined in the SEND and AP Green Paper. It’s clear the current system is not working for children or their families, schools and local government, and that we need to work together, in partnership with parents, to ensure that the new SEND system does.

Since 2014, we have seen a near doubling of children with identified special educational needs and recent estimates suggest high needs budget deficits could reach £3.6 billion by March 2025. Despite a recent injection of funding, the green paper did not acknowledge that costs are baked into the system for years to come, quite possibly until all children currently in the system reach 25 years.

The number of children who have Social, Emotional and Mental Health (SEMH) as their primary need for an EHC plan has increased significantly and we have seen a drastic increase in the number of children who require mental health support too. NHS Digital figures show that one in six children had a probable mental health disorder 2021, before we even consider the impacts of the pandemic. We need to reflect on why these numbers are rising and ask what this says about us as a society.

The SEND system is based on a medical model of disability, one which assesses and identifies the needs of children but then remain relatively fixed. It’s not clear to me that this is the right model; within any reforms that are to come, we need to support a shift in the system so the underpinning principles are around a proportionate and dynamic response. SEMH and Speech language and communication categories of special needs are, by definition mutable and improvable for many children especially where we can bring the right support and interventions around the child and family at the earliest possible stage.

I believe we should be paying serious attention to the context and environment in which our children are growing up in. How society’s norms and cultures heap expectations on children to succeed, the impact of inequalities and the ever creeping sense of doom from pandemics, climate crises, war, the cost of living crisis and more. We need to think about how we help our children to thrive in difficult and anxious times whilst not being too quick to give them a label that will stick with them and may not always be the best way to support them in the long term. As we work alongside the government and others towards a better SEND system for children this is food for thought. Ultimately, though we need a country that works for all children and families.

This colmn first appeared in CYP Now - Policy Context: Social, Emotional and Mental Health Needs | CYP Now.

Related Articles

There are no entries available.

ADCS response: Commission on Young Lives

Steve Crocker, ADCS President, said:

“The Commission’s final report draws on the findings of its four thematic reports to set out a national plan of action for change. Any efforts to prevent children and young people from adversity, exploitation and harm are welcome. The report calls for a focus on earlier support for children and their families to prevent crises and for a greater level of investment in them, both of which are long overdue. We agree with the Commission that the recommendations from the children’s social care review must not be ‘kicked into the long grass’. We need to change parts of the system that are not working for children and families, significant government investment is needed to achieve this.

“Youth services are a key part of early help, they offer young people positive activities, opportunities, and safe places to go, yet they were amongst the many vital services local authorities were forced to cut during a decade of austerity. There is a clear role for youth services to play in helping children and young people recover from the effects of the pandemic too. Now is the time for ‘a return to investing in children and their families’ and the services that support them, not a return to austerity.

“The Commission adds its voice to calls for youth justice reforms, for urgent action on child and family poverty and on removing the racial biases that children face. It also calls for desperately needed investment in a mental health recovery programme for children and young people. Serious violence, criminal exploitation and harm should be a national priority, and so should providing help and support to children and families at the earliest possible opportunity. The country is facing many competing challenges including the ongoing impact of the pandemic and a cost of living crisis and the Chancellor will have some tough decisions to make. However, children must not bear the brunt of austerity again; the financial and human costs would be too great.”

ENDS

Related Articles

There are no entries available.

NCASC 2022 Speech

NCASC 2022

On 2 November Steve Crocker made his keynote address to the National Children and Adult Services Conference.

Related Articles

There are no entries available.

Comment: Research by the Uni of Oxford on children’s homes...

ADCS President, Steve Crocker, said:

“The children in our care deserve the very best care that meets their needs and gives them every opportunity to thrive in life, ideally as close to the people and places they know as possible. However, finding the right placements for children when and where they need it, is a significant challenge when the number of children in our care is increasing and demand for places far outstrips supply. Moreover, local authorities are the only purchasers of placements so providers can pick and choose who to accept and at what cost.

“This important research fills a gap in our knowledge about the impact of the creeping privatisation of the children’s residential care market. Researchers raise several important issues worthy of further discussion and debate, especially around the quality of care and the ability of local authorities to find the upfront investment in building new public sector provision. These findings should certainly be considered by the government as it continues to develop its response to the independent review of children’s social care.

“Children’s services have long operated in a mixed economy with what were previously small scale private, voluntary, charitable and community providers involved in the delivery of services locally, however, ADCS remains concerned about the growing levels of risk in the system due to rapid changes in ownership, leading to a dash by new owners for excess profits and considerable levels of borrowing and debts held by some private companies offering care placements. Should any of these providers fail, no single local authority could step in, and it would be children who suffer the greatest consequence.